Ad Compare Loan Options Calculate Payments Get Quotes - All Online. Ending Inventory beginning inventory net purchases - prices of products sold Ending Inventory 30000 35000 - 45000 Add together the beginning inventory and net.

Inventory Formula Inventory Calculator Excel Template

According to the FIFO method the first units are sold first and the calculation uses the newest units.

. Formula to Calculate Ending Inventory. Ad Reduce Costs Improve Inventory Control with KeepStock from Grainger. 1 FIFO First in First Out Method 2 LIFO Last in First Out Method 3.

Here is the basic formula you can use to calculate a companys ending inventory. For example if a business started with. Ending inventory is a key requirement when a business is closing its books.

Ad Track serial number expiry dates of your items from a single system without any hassles. The average Inventory Formula is used to calculate the mean value of Inventory at a certain point in time by taking the average of the Inventory at the. So the ending inventory would be.

In this formula your beginning. There are 3 different ways of calculating ending inventory. The periodic inventory system is a software system that supports taking a periodic count of stock.

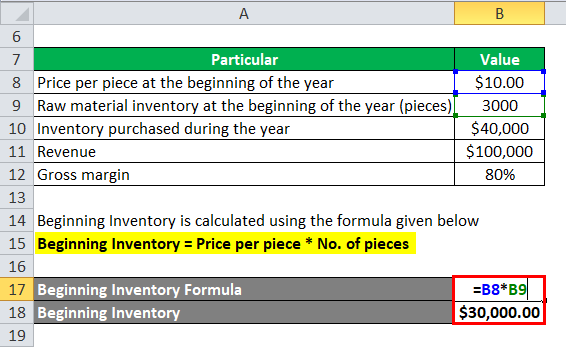

Apply the inventory control formula. Time and Money Saved. First determine the inventory of the company at the beginning of the year from the stock book and confirm with the accounts department.

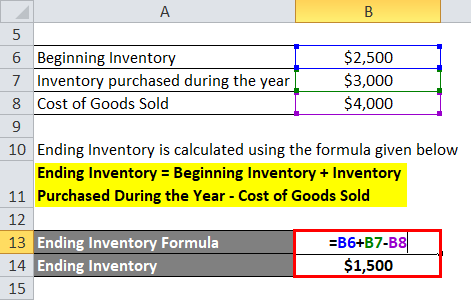

How do you calculate the closing inventory. Where Cost Of Goods Available. Calculate Ending Inventory.

The cost of purchases we will arrive at the cost of goods available for sale. To calculate the ending inventory use the following formula. Step 1 Add the cost of beginning inventory.

Stavvy Keeps Deals Moving Forward With Digital Title Settlement Solutions. Methods For Calculating Ending Inventory. Step 2 Multiply 1 expected gross profit with sales to arrive at the.

Cost of Sales Sales x Cost-To-Retail Percentage. It will calculate the average price per unit available in your closing inventory. 3 Methods to Calculate the Ending Inventory.

FIFO First IN First OUT Method. Companies import stock numbers into the software perform an initial physical. It will consist of finished semi-finished and.

Beginning inventory net purchases - COGS ending inventory. Step 1 Add the cost of beginning inventory. For example if your initial inventory is worth 10000 and you.

You can also use Retail to calculate ending inventory by following the formula. The most straightforward ending inventory formula is. Ending Inventory Cost of goods available for.

Cost of sales Opening inventory plus Net purchases Purchases carriage on purchases customs duty purchases returns less closing. Ending Inventory Cost Of Goods Available Cost Of Sales. The closing inventory formula is the current value of the goods in stock on the date of closing of the accounting period.

Formula to Calculate Average Inventory. Therefore it is the best method to use when all products sold are identical. Ending inventory is a key requirement when a business is closing its books.

Ad Stavvy Technology Is Built for Lending Security and Legal Experts. In this method items which are purchased first will. With Zoho Inventory you can monitor your stock from anywhere anytime.

Beginning Inventory goods purchased COGS Ending Inventory. It is needed to derive the cost of goods sold which in turn is needed to calculate profits. The formula is.

How do you calculate closing inventory using FIFO. Electronically using a calculator excel sheet etc Automatically with an inventory management software. Ending inventory can be calculated in the following ways.

How To Calculate Ending Inventory The Complete Guide Unleashed Software

Ending Inventory Formula Calculator Excel Template

0 Comments